KLCI Rebounded Strongly This Morning, Is the Bear Gone?

17 Sept 2015 -KLCI shot up nearly 40 pts this morning, and managed to sustain at 1680 pts in the morning session. Traders shall hail as the index recovers.

However, long term investors shall remain cautious as global market fundamental remain lackluster. Commodity prices remain low. Companies started retrenchment. Seagate has earlier retrenched near 1000 staffs globally and now HP plans to reduce 33,000 jobs.

Earlier, several banks in Malaysia like CIMB, RHB and Hong Leong has also undergone restructuring and headcount reduction. It seems that businesses are trying to reduce their overhead under difficult market environment. This is definitely a sign to watch out. If the trend of retrenchment persist, it could be an early sign of possible economic recession.

The FOMC meeting outcome is coming out tomorrow. It seemed like today is a speculative recovery as most people are expecting favorable outcome from the meeting. Even if the rate hike is postponed it may not mean the economy is doing fine and market shall cheer. It is just a sign that the US economy is still too vulnerable for a rate hike. Trade cautiously.

Thursday, 17 September 2015

Monday, 14 September 2015

Najib's RM20billion ValueCap Initiative Going to Save Malaysia Market?

Najib's RM20billion ValueCap Initiative Going to Save Malaysia Market?

14 September 2015 - The Prime Minister cum Finance Minister of Malaysia Dato Seri Najib Tun Razak has announced that the country is going to revive the ValueCap; a dormant equity investment firm set up in 2002 to invest in undervalued equities. RM20 billion will be parked under the firm as an initiative to support the recently battered KLSE market.

The news came out in early afternoon today. The Index was seen climbing with strong momentum in the afternoon session and closed up 36.03pts. Many people must be asking whether the fund is really going to save the Malaysia market. Lets not mention whether the RM20billion is going to save the market, but the confidence effect of the announcement is already been seen in the number of movement of the KLSE index itself. Therefore, no doubt the KLSE index will see an uptrend in near term.

- Until last week (11/9/15), the local capital market has experienced a net selling of RM17 billion; whereas the whole year figure in 2014 was net selling of RM7.8 billion. Technically, if combine both figures it worked out to be RM25billion roughly.

- The recovery uptrend can be sustainable, if the foreign selling pressure stops. The fundamental reason of the selling of the Malaysian stocks by the foreign funds is because of the deteriorating economic outlook at the emerging market, especially the Asia region where most raw materials and commodities are produced. The uncertainties in the US policy and also slowing down of 2 biggest economies in Asia (China and Japan) is worrying the oversea investor.

- The large scale selling was a systemic operation of the funds and institution oversea to cut down exposure in the emerging market. Other than concerning with the depreciating ringgit and dropping equity valuation, they are more worried whether the companies they invested in Malaysia is going to continue to deliver better result than many other investment options all around the world.

- We must remember that these are funds managing hundreds and thousands of millions worth of aset and they are responsible to ensure their asset value grow year by year, And when they invest in a stock, they do not invest just one or two hundred thousand ringgit. They must have done a very thorough studies and accumulated over a long periods to their holding positions today.

- These funds would not simply sell so massively just because the market is technically dropping and fundamental still intact. Because for a mammoth fund holding, for them to sell even a single digit percentage of their holding in a company is sufficient to cause the price to drop very significantly and therefore affect their overall asset valuation.

- But if they realized that the overall economy is not going to improve, and the businesses they invested here is not going to deliver better numbers in mid to long term, they may want to liquidate their funds and invest else where rather than losing the opportunity cost of holding on to a weakening business and run the risk of decreased earning multiply by decreased valuation.

- So, coming back to our main question today, is RM20billion going to solve the problem forever and save the market from dropping? No one has have a definite answer, but based on the current situation, it is unlikely to last long as the fundamental economic risks in the emerging markets has not been disarmed. China market is a good example. Even though the composition of the market participant is different with majority retail investor who are highly speculative, the several rounds of interest reduction and government and investment firms pledge to buy the stocks, the so called recovery was temporary. Once people start to cool down and realize the initiative just change the valuation but now the fundamental economy behind the businesses; even if the 20 Billion can support the selling of the foreign fund or even push up the index the foreigner will not stop selling; save and except they see a light that the economic in the emerging market is going to improve.

- This is because the ValueCap initiative is not going to improve the earning of the business they invested but rather artificially pushed up the valuation for the counters temporarily, giving the foreign funds to dispose at a better price.

- For market to recover and foreigners to feel confident towards the emerging economies again, first of all the commodities prices must be stabilized. Overall market sentiment in the commodity market has been deteriorating due to poor consumer indication in the few largest economies all over the world. Spending data and consumption has to improve to reverse the situation. Oil price will have to recover; someone will have to put an end to the crude oil war between the US and OPEC.

- Rather than spending RM 20 billion to prop up the share market, I think out government can do better in formulating new policies to further stimulate and promote local businesses. Spend to improve the infrastructure of the nation and prepare budget help to promote local goods and services overseas. Spend to retain the local talents. Spend to introduce latest techniques and technologies in the market into Malaysia. Spend to subsidize employment of oversea talents. These spending may not save Malaysia from foreign selling now, but will definitely help to transform Malaysia bit by bit from commodity based economy to knowledge and skill based economy, and so reduce the impact of commodity movement on the local economy. When the overall market recover, a better than average recovery in the economy nationwide can be observed, not only in the recovery of index but also fundamentally better corporate earnings and economic data can be expected.

Friday, 11 September 2015

The Health Benefits of Consuming Almonds

The Health Benefits of Consuming Almonds

Heart

Probably almonds’ best-known quality is that they are good for your heart. “Nearly two decades of research shows that almonds can help maintain a healthy heart and healthy cholesterol levels,” said Heap. A 2009 article in The American Journal of Clinical Nutrition (AJCN) looked at the evidence on nut consumption and a variety of health issues. It noted that in four large-scale studies considered major in the field — the Iowa Women's Health Study (1996), the Adventist Health Study (1992), the Nurses’ Health Study (1998) and the Physicians' Health Study(2002) — nut consumption was linked to a lower risk for heart disease. Together, the studies showed an average reduction in the risk of death from heart disease by 37 percent, or “8.3 percent … for each weekly serving of nuts.”

“A growing body of evidence suggests that regularly choosing almonds in place of snacks high in refined carbohydrates is a simple dietary strategy to help support heart health,” said Heap. In another evidence review, published in 1999 in Current Atherosclerosis Reports, researchers looked at the Nurses’ Health Study and estimated that eating nuts instead of an equivalent amount of carbohydrates reduced heart disease risk by 30 percent. Substituting nuts for saturated fats, such as those found in meat and dairy products, resulted in a 45 percent estimated reduced risk.

Replacing almonds with saturated fats may also help lower LDL (bad) cholesterol levels. A 1994 study published in The American Journal of Clinical Nutrition looked at men with normal cholesterol levels and found that those who supplemented their diets with almonds for three weeks saw a 10 percent reduction in LDL levels.

Additionally, a serving of almonds provides 5 percent of the recommended daily value of potassium, which is necessary for heart health, according to the American Heart Association. Many studies have linked potassium with lower blood pressure because it promotes vasodilation (widening of blood vessels), according to Today’s Dietitian. The magazine article cited a study of 12,000 adults, published in Archives of Internal Medicine, which showed that those who consumed 4,069 mg of potassium each day lowered their risk of cardiovascular disease and ischemic heart disease by 37 percent and 49 percent, respectively, compared to those who took 1,793 mg per day.

Magnesium is also essential for heart health. According to the University of Maryland Medical Center, some doctors have seen positive results from giving patients who have suffered from heart failure doses of magnesium. There also may be a link between lower heart disease risk in men and intake of magnesium.

Heap noted that in 2003, the FDA approved “a qualified health claim recognizing that California almonds may help reduce the risk of heart disease." The official statement said:

"Scientific evidence suggests, but does not prove, that eating 1.5 ounces of most nuts, such as almonds, as part of a diet low in saturated fat and cholesterol may reduce the risk of heart disease. One serving of almonds (28g) has 13g of unsaturated fat and only 1g of saturated fat.”

Almonds may even be good for those suffering from hyperlipidemia (excess lipids or lipoproteins in the blood). These patients used to be instructed to stay away from nuts because of their fat content, but a study published in 2002 in the journal Circulation showed that hyperlipidemic patients who ate almonds as snacks actually saw significant reductions in heart disease risk factors.

Weight loss and preventing weight gain

“With their combination of protein, fiber, good fats and satisfying crunch, almonds are a smart snack option to help keep hunger at bay while satisfying cravings,” said Heap. While she noted that “numerous studies have shown that choosing almonds as a daily snack does not lead to changes in body weight,” substituting them for other snacks may help dieters. A 2003 study published in the International Journal of Obesity and Related Metabolic Disorders suggested that combining almonds with a low-calorie, high-monounsaturated fat diet led to more weight loss than did a low-calorie diet with lots of complex carbohydrates. Another recent study, published in 2015 in the Journal of the American Heart Association, looked at substituting almonds for a muffin of the same caloric value and found that though participants did not lose weight in either group, the almond-eating group saw a reduction in abdominal fat, waist circumference and fat on the legs, as well as improved LDL cholesterol levels.

Almonds can also be a more satisfying snack than high-carb counterparts. “Their combination of protein, fiber, and good fats makes them a satisfying snack choice that can help keep you from reaching for empty calorie choices between meals,” said Heap. “In fact, a recent study showed that women who ate a mid-morning snack of 1-1.5 ounces of almonds felt more satisfied and ate fewer calories at subsequent meals.”

As if that weren’t good enough news, almonds may also help prevent weight gain. A Spanish study published in 2007 in the journal Obesity found that over the course of 28 months, participants who ate nuts twice a week were 31 percent less likely to gain wait than were participants who never or rarely ate nuts.

Good for gluten-free dieters

“Almonds are naturally gluten-free, and are a versatile, nutrient-rich addition to gluten-free diets," said Heap. "Because gluten-free diets can be low in iron, fiber, B vitamins and protein, and high in saturated fat and sugar, it is important to help fill these gaps and optimize nutrition. All forms of almonds, including almond flour, almond milk and almond butter, are excellent additions for those choosing a gluten-free lifestyle.”

Diabetes

According to the AJCN review of nuts and health outcomes, the links between nut consumption and diabetes risk and symptoms are less clear than with heart disease. Nevertheless, the Nurses’ Health Study showed an inverse relationship between regular consumption of nuts and diabetes, as did the Shanghai Women’s Health Study (2008).

Additionally, there is some evidence that almonds can be helpful in regulating blood sugar levels. A 2006 study published in the Journal of Nutrition looked at giving participants controlled meals based either around almonds, rice, potatoes or bread. Researchers found that participants’ blood sugar and insulin decreased after eating the almond meal but not the others. Also, antioxidants in the blood increased after the almond meal, while they decreased after the other meals.

Almonds may also help lower the glycemic index of a high-glycemic meal. A 2007 study, published in the journal Metabolism, looked at combining almonds and bread-based meals. The more almonds participants ate, the lower the meal’s glycemic index became and the less the participants’ blood sugar levels rose. Eating three ounces of almonds with the bread-based meal lowered the meal’s glycemic index to less than half of that of the bread-only meal.

Energy

These tasty tree nuts can help you get moving. They are a very good source of energy-encouragers riboflavin, manganese and copper. Riboflavin is also known as vitamin B2, and it helps produce red blood cells and release energy from the carbohydrates you eat, according to the National Institutes of Health. Manganese and copper are components in an enzyme that stops free radicals in mitochondria, where our cells produce energy, according to World’s Healthiest Foods. In this way, these trace minerals help maintain your body’s energy flow.

Prevent gallstones

The fat and fiber content in almonds may help prevent gallstones by keeping your gallbladder and liver running smoothly. An analysis of the Nurses’ Health Study showed that frequent nut consumers were 25 percent less likely to need a cholecystectomy, a procedure to remove the gallbladder that is often done to treat gallstones. Another study, published in 2004 in the American Journal of Epidemiolgy found similar results in men, with frequent nut consumers seeing a 30 percent decreased risk in gallstone disease.

Cancer

According to the AJCN nuts and health review, some studies suggest that there might be a relationship between nut consumption and reduced cancer risk in women, especially for colorectal and endometrial cancers, but these studies do not focus on almonds specifically. One animal study published in 2001 in Cancer Letters looked at whole-almond consumption in rats and found that those who ate almonds had fewer cancer cells in their colons.

Additionally, the antioxidants and vitamin E in almonds may have cancer-fighting benefits, though the National Cancer Institute warns that results from studies examining antioxidants, vitamins and cancer are inconclusive.

(Source: www.livescience.com)

Tuesday, 1 September 2015

Achieve More by Doing Less

Achieve More by Doing Less

Doubted if you have read the title correctly? Do not worry, you've

got it right. You can actually achieve more by doing less. The question is,

how?

First, we need to master the art of doing nothing. By

doing nothing, it means rest. Many people are deprived of sleep nowadays. We

work day and night under pressure to meet demanding deadlines. We are tensed up,

and so stressed that we often failed to notice what we are in a viscous self-defeating

cycle. Nowadays we are playing multiple roles in our daily lives. To live up to

other’s expectation and to avoid disappointing the people around us, we are

taught to never say NO when people make requests.

Many

times, we are made into believing that we can achieve batter result by doing

more. Therefore, we keep our schedule as tight as possible, end to end. We have

become so blinded by the secular value and the expectation from the external

environment; eg. from our superior, from our spouses, from the school, etc.

We

have always been told that the most successful people are the most hardworking

people in the world. We read motivational articles citing successful figures

and described how those people worked until late night every day and wake up

next day early morning before dawn to achieve who they are today. However, is

that really the truth? Is that the best way to be successful?

Robert

Kwok, the richest man in Malaysia, during his interview in 2011 with CNTV, said that

one of his secret of success is that he has a simple night life.

He rest early at night, to ensure that he can be at tip top condition the

next day.

Li Ka-Shing, the richest Chinese entrepreneur in

the world, keeps his work desk clean all the time. He is known as Superman because of his great success in managing his mammoth corporation. Contrary to common belief, he do not do many things at once;

he only selectively attend to important things, and he makes sure he completes

what he started.

1. It is not how many things we have

done but how many important things we have completed that counts.

2. Without proper sleep, our cognitive

function may not perform best when we needed it most.

3. When we make mistake, we actually

spend more time to correct it than to avoid the mistake. Sleeping an hour

earlier may avoid blunder that would take a few hours to rectify.

4. Sometimes good opportunities are

hard to come by. We miss it, that’s it. It cannot be compensated with extra

efforts. We are losing more opportunities than we know when we failed to stay

alert due to lethargy, a result of overwork and sleep deprivation.

5. When we are reluctant to decide what

to attend to and what to reject, it could mean that we are not confident.

People tend to make themselves feel good/important by appearing busy and

attending to many tasks. These are the people who are inferior in nature. To

cover their inferiority, people tend to act the opposite way, to convince

themselves of their importance by “accumulating” tasks.

6. Human body

is the most delicate and complicated machine in the world, that even the most

knowledgeable medical practitioners has yet to fully understand how our body

works. Worse of all, we do not have spare part for our vital organs. Once our

body start to fail, all is over.

7. A healthy body is our biggest

capital. We can only achieve more when our mind and body operate at optimal

condition. Resting is a vital process which our body heals itself. By

resting properly, we can achieve more by doing less.

Wednesday, 26 August 2015

Efficiency VS Effectiveness - Are you effective?

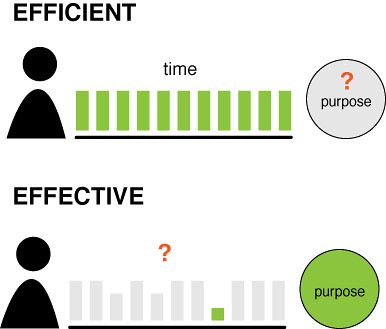

1. Efficiency and effectiveness may sound the same but they mean so much different.

2 The first one is quantifying, whereas the later one is qualifying.

3. Efficiency is about how many tasks one can finish within a stipulated time frame.Effectiveness is how close a person towards his objective.

4. For instance in a restaurant, if chef A can fry 100 eggs in 30 minutes while chef B can only fry 80 eggs in 30 minutes, chef A is considered more efficient than chef B. However, when chef B gets 70 happy customer after eating the eggs while chef A only get 60 happy customers, chef B is said to be more effective than chef A.

5. Nowadays many people are working under extreme pressure and forced to meet strict deadlines. We are consorted to achieving high efficiency the great amount of stress, which in turns sacrifices effectiveness.

6. But without a firm awareness and clear direction of where we are heading, we are doing nothing but like a blindfolded bull trampling around- a waste of our energy and resources.

7. Many of us gotten ourselves busy by taking up a lot of tasks and responsibilities, believing that the more we do, the better we gain. But is this always true? A bull plowed all his life, but he never get a single pence from the paddy field. Many people kept themselves busy, ended up building other people's dream.

8. The key to effectiveness here is being selective. Successful people learn how to say NO. While it can be true that by getting our selves involves in many activities and challenges may opens up a door to more opportunities, but one must always remember that everyone of us has a very limited resources. Time is our limiting factor.

9. How to select? Before we make decision, we must know very clearly what we want in life. setting a lifetime TARGET is like setting an anchor in life. We must know ourselves, and what we want so we have a direction in life. From there we decide when to say yes and no to the opportunities offered to us.

10. The next key word is RELEVANCE. Commit only on things that is relevant the target we set. Many people are feeling lost in modern days because we have been doing too many things that are irrelevant in our lives, which con-sequent into losing focus in life. We become lost in life and do not know what we want anymore. To avoid that, we must learn to say no to things that is irrelevant to our goals.

11. Remember, a busy person may not be a productive person. Our sense of fulfillment in life come from achieving what we want; and we must know what we want before we can achieve it. Be effective and do relevant things so we can progress in our life.

Monday, 24 August 2015

Bear Dances Amid East and West Orchestra - Where is the market heading?

Bear Dances Amid East and West Orchestra

1.(24 August 2015) today major Asian indices closed red. (yea i know whole world closed red but let's just focus on the Asian indices now)See below:

2. Again, Shanghai index was the biggest loser, plummeted a huge 8.34% at closing. the rest of the markets are not doing any better, with averagely 3 to 5% down.

3. This evening, another breaking news shocked the market. US Dow Jones index gap down by 1000 points when the market opened. although the index climbed back subsequently, it showed us that the market is now very sensitive and emotional.

4. Likelihood that the initial sell down was due to the fear that the Asian market slowdown may directly hit the US market. After observing such a major cutback in Asian indices, I believe many investors from the state must have been freaked out.

5. The fear of another global financial crisis has brought the DJI to a historical drop since 2007.

6. As for Asian market, main markets opened lower to the previous closing price.

7. It was reported that US market indices closed lower on last Friday, DJI was 531 points lower at the closing session, which is considered a significant figure as it has been a long time since DJI droped more than 500 points in a single day trade.

8. Technically, it is seen that the eastern and the western market is playing a fear-induced orchestra, a positive feedback was observed in the market trend of both side of the world. The fear of one market's weakness send the other market weaker.

9. Fundamentally, the Asian market is worrying about the Federal rate adjustment in September, and the dampening Eurozone economy and unsolved Greece issues. On the west side, the States are worrying that slowing China statistics and continuous dropping commodity prices may hurt the economy of the emerging markets and Asian countries are expected to be impacted.

10. Meanwhile, since China dropped their currency weeks ago, people has grown wary with the PBOC's next move. It's believed that the China central back will continue to de-valuate their currency if the export figure hasn't been improved.

11. It's said that China has overbuilt their production capacities over the year, even with such a huge population, the slowing economic growth over the years may indicate that the people's ability to consumes could be getting saturated.

12. After all, China GDP per capita is just 7.5k, still lower than Malaysia's 10k. This is due to a huge gap in dispersion of wealth in the country.

13: Inference: The market is fear driven now. The bear started to dance as the east and west market are starting to orchestrating with one another, technically and fundamentally; due to many unsolved issues in the economy of both worlds and uncertainties in the monetary policy of the 2 world largest economy. Buy your pop corn and enjoy the show!

1.(24 August 2015) today major Asian indices closed red. (yea i know whole world closed red but let's just focus on the Asian indices now)See below:

2. Again, Shanghai index was the biggest loser, plummeted a huge 8.34% at closing. the rest of the markets are not doing any better, with averagely 3 to 5% down.

3. This evening, another breaking news shocked the market. US Dow Jones index gap down by 1000 points when the market opened. although the index climbed back subsequently, it showed us that the market is now very sensitive and emotional.

4. Likelihood that the initial sell down was due to the fear that the Asian market slowdown may directly hit the US market. After observing such a major cutback in Asian indices, I believe many investors from the state must have been freaked out.

5. The fear of another global financial crisis has brought the DJI to a historical drop since 2007.

6. As for Asian market, main markets opened lower to the previous closing price.

7. It was reported that US market indices closed lower on last Friday, DJI was 531 points lower at the closing session, which is considered a significant figure as it has been a long time since DJI droped more than 500 points in a single day trade.

8. Technically, it is seen that the eastern and the western market is playing a fear-induced orchestra, a positive feedback was observed in the market trend of both side of the world. The fear of one market's weakness send the other market weaker.

9. Fundamentally, the Asian market is worrying about the Federal rate adjustment in September, and the dampening Eurozone economy and unsolved Greece issues. On the west side, the States are worrying that slowing China statistics and continuous dropping commodity prices may hurt the economy of the emerging markets and Asian countries are expected to be impacted.

10. Meanwhile, since China dropped their currency weeks ago, people has grown wary with the PBOC's next move. It's believed that the China central back will continue to de-valuate their currency if the export figure hasn't been improved.

11. It's said that China has overbuilt their production capacities over the year, even with such a huge population, the slowing economic growth over the years may indicate that the people's ability to consumes could be getting saturated.

12. After all, China GDP per capita is just 7.5k, still lower than Malaysia's 10k. This is due to a huge gap in dispersion of wealth in the country.

13: Inference: The market is fear driven now. The bear started to dance as the east and west market are starting to orchestrating with one another, technically and fundamentally; due to many unsolved issues in the economy of both worlds and uncertainties in the monetary policy of the 2 world largest economy. Buy your pop corn and enjoy the show!

Sunday, 23 August 2015

China Smartphone Sales Drop For the First Time

1. China smartphone sales in last quarter reported 4% drop for the first time.

2. China is the largest smartphone market in the world, consuming 30% of the world's phone sales in last quarter.

3. Market predicted that the smartphone market in China has reached saturation.There are fewer first time buyer in China and most of the people are merely replacing their old phones, said Anshul Gupta, research director at Gartner.

4. Globally, the sales of smartphones still reported a positive growth of 13.5%, even though it represents the slowest growth throughout the years.

5. Apple saw increase in their market shares compared to the same period last year while Samsung market share was slashed by 4.3%.

6. While many semi conductor related company are still actively spending money into capacity expansion, by the time the new production facility is ready to run, will the demand catch up with the increase in supply, or will it cause another oversupply issue in the technology sector?

Saturday, 22 August 2015

Economy Outlook: KLCI Stood Still Amid Dropping World Indices. Malaysia Boleh?

Economy Outlook: KLCI Stood Still Amid Dropping World Indices. Malaysia Boleh?

1. 21st of August 2015 is a significant day to remember. Almost all the major indices in the world closed red. (See pictures below taken from Yahoo)

2. Shanghai Composite Index led the fall, by closing -4.27%, then Taiwan Weighted Index was the second biggest loser at -3.02%. Even Hong Kong and Singapore indices also closed down 1.53% and 1.29% respectively.

3. Among all the Asia Pacific major indices, New Zealand NZSE 50 index was the only winner of the day. Surprisingly, KLSE was the strongest among all the loser, with only 0.17% lower at closing.

4. Dow Jones Index also saw a decline of 531 point on Friday trading. According to CNN Money, the 3 main reason the global market contracted are :

i) Slowing China economy - the world second largest economy

ii) Uncertainty in US federal rate revision in September as the federal bak has been sending "mixed signals"

iii) Commodity prices has weaker trend

5. Question: Does this means that KLSE is stronger than the rest of the Asia Pacific major capital markets? We all know that KLSE has just taken a hard fall recently, following a series of political scandal involving PM Datuk Seri Najib Tun Razak,

6. The situation was exaggerated by devaluation of Yuan and falling commodity prices, which induced fear among global investor, and constant exodus of funds from Malaysia is frequently observed.

7. Let's study the day chart of KLSE on 21st August 2015 as per attached below:

8. The Index opened lower in the morning session but gained it's strength subsequently over the first half session. In the second session, the index was supported above the opening position, until the pre-closing. At the end of the session, the index closed down 0.17%.

9. Lets see what happened to Shanghai Index and Taiwan Index

10. Both the top losers are seen a constant downtrend in their index movement. Even SSE shows a higher movement, the downtrend can still be observed.

11. Now let's look at the Bursa Malaysia Daily Trading Statistics on the day.

13. Inference: The local institutions are actively buying the stocks to support, instead of taking a passive position to defend the market. This could be a sign that the resilience we seen in the KLSE last Friday was artificial.

14. If local institutions EPF, RFI, Tabung Haji, Unit Trust funds etc to support the local market indifinitely, how long can they sustain? That is a different topic we will discuss in another separate post. Stay Tuned.

Friday, 21 August 2015

How To Sleep and Wake Up Refreshed

How to Sleep and Wake Up Refreshed

1. Avoid mental intense activity 1 hour before going to bed, and avoid heavy exercise 2 hours before sleep. Your brain and body will need some time to cool down before getting to rest, just like a car engine.

2. Avoid consuming stimulating food and drinks like chocolate, coffee and tea after evening. Alcohol is a no-no. Many people think that alcohol make people sleep better, ironically alcohol consumption will disrupt the REM stage of the sleep and make you feel sluggish when you wake up next day.

3. Milk have calming effect, but be reminded not to drink too much. half a glass is good enough. Your stomach need to rest too during sleep. Do not consume any solid food an hour before sleep.

4. Get yourself 15 minutes of quiet moment. Lay on your bed, do not do anything during that time. Close your eyes and take a few deep breath slowly. Focus on your breath. Count to 4 when you breath in, count to 6 when you breath out.

5. Bed is only for sleep. Do not do your work or reply email on your bed. You need to condition your body and mind that your bed is a sleeping place. Otherwise, your subconscious mind will remind you about your work when you lay down on your bed.

6. Keep yourself hydrated throughout the day. A glass of warm water upon waking up will help you to wake up your organs. It is kinda like rebooting your system for the day.

7. If you could not finish your important task for the day, note down your to-do on a piece of paper and then forget about it. First thing you wake up next day is \check out the note, it will help you to set a target for the day and keep you awake.

8. Our body has a biological clock that needs "Tuning". Sleep and wake up at regular hour will help to improve sleep quality.

9. Switch off all unnecessary lights before you sleep. Light will disrupt melatonin production in our peneal gland, a specific hormone that regulates the sleep-wake cycle.

Most Important Things To Remember During Difficult Times

Most Important Things To Remember During Difficult Times

2. Remember to draw a line between Past, Present, and Future. We live in the present. Nobody can change the past, nobody can predict the future.

3. Remember not to focus on things that we cannot change, but on things within our circle of influence.

4. Remember what you do today will not change anything in the past, but will definitely decide what to happen in the future.

5. Denial is not going to make anything better. Remember to acknowledge your feelings, learn to accept yourself, accept the circumstances.

6. Remember that everyone is so poor at remembering, nobody is going to remember your mistake.

7. Remember life short, every moment is worth appreciating. Not all is lost as long as we are still alive at THIS MOMENT.

1. Remember the greatest law of universe - Everything is Cyclical. The sun, the Earth, the Moon, the season, the weather, the market, and even our life. The creator is reminding us that nothing last forever. Even the best moment in you life has come to past, so what make the worst moment last forever? Thing will come to past one day and time is our best healer.

2. Remember to draw a line between Past, Present, and Future. We live in the present. Nobody can change the past, nobody can predict the future.

3. Remember not to focus on things that we cannot change, but on things within our circle of influence.

4. Remember what you do today will not change anything in the past, but will definitely decide what to happen in the future.

5. Denial is not going to make anything better. Remember to acknowledge your feelings, learn to accept yourself, accept the circumstances.

6. Remember that everyone is so poor at remembering, nobody is going to remember your mistake.

7. Remember life short, every moment is worth appreciating. Not all is lost as long as we are still alive at THIS MOMENT.

The New Era in Malaysia Economy

|

| Source: Malaysia Chronicle |

1. The Foreign Reserve in the Federal bank drop below USD 100 Billion for the first time since post-2008 crisis.

2. Malaysian Ringgit depreciated to RM 4.12 to 1 USD on 17 August 2015, the lowest sin 1997 Asia Financial Crisis.

3. Devaluation of Chinese Yuan on 11st August 2015 has caused a panic across the Asia markets, triggering the fear of a currency war that may simulate the 1997 Asia Financial Crisis. Funds are leaving several major stock markets in Asia. Most of the Asian currency has depreciated against USD 3 days streak after the surprising move by China.

4. Weakening commodity prices, especially crude oil and palm oil prices, further reduce the confidence of investors towards Malaysia.

5. Brent oil price stood at USD 47.21 per bbl; a 56% discount from it's peak at USD 105 per bbl about a year ago. Petronas, a state-owned oil and gas giant, has seen a whopping 57% drop in the upstream business revenue, from RM 32.4 billion to RM 14 billion comparing year -to-date in FY14 and FY15.

6. The palm oil price also dropped 56% from USD 1,250/MT to USD 575/MT.

7. GST of 6% was imposed starting 1st April 2015. Malaysians has to pay more for the same goods, which in turn discourage consumer spending especially the wage earners.

8. Property market also slowdown recently, making the property stocks lackluster. Federal loan tightening has led to increased loan rejection rate among home buyers. Foreign speculators are filter out of the market since the RPGT was drastically increased since 2013.

9. Debt laden government investment arm 1MDB was revealed to have invested the money without due diligence, and accumulated a 42billion debt over the years. Since then, foreign funds has started to leave Malaysian capital market. RM 9.152billion funds has left Malaysia in 2014.

10. The capital exodus is exaggerated up to RM15billion has left Malaysia up to mid August 2015, when the Prime Minister is involved in a political scandal of receiving a RM2.6 billion "Political Donation" from abroad, and a series of extreme measure taken to interrupt the investigation against him.

11. International investors has decided to leave Malaysia, despite that the Federal Governor Tan Sri Zeti Aziz reiterated that Ringgit is undervalued on 13 August 2015. Earlier in April 2015, she made a similar statement when Ringgit was observed at a depreciating trend.

12. Hidden risk ahead as the United States Federal Reserve rate revision in September 2015, further expanding the gap between the weakening Asian currency against USD.

13. Even though China has stated that the Chinese Yuan devaluation was a one-off event on 11st August 2015, the Yuan was de-valuated further in the next day. There is still a possibility for China to make currency adjustment whenever deemed necessary. China GDP growth is seen slowing down to 7.7% since their last peak in 2007, at 14.2%.

14. Malaysians are very much angered by the recent political dramas and the mishandling of taxpayer's money by the government and the fact that they felt democracy is being challenged. A Bersih 4.0 Rally is scheduled on 29th and 30th of August. Too many uncertainties at this moment to predict what will actually happen during the rally, as the ruling coalition has been growing extremes in the measures taken to ensure the continuation of their reign.

15. Foreign Direct Investment (FDI) was almost halved in 1H2015 compared to previous year, dropping from RM 36.6 billion to RM 21.3 billion despite a 1.3% growth in overall investment in Malaysia to RM 113.5billion.

2. Malaysian Ringgit depreciated to RM 4.12 to 1 USD on 17 August 2015, the lowest sin 1997 Asia Financial Crisis.

3. Devaluation of Chinese Yuan on 11st August 2015 has caused a panic across the Asia markets, triggering the fear of a currency war that may simulate the 1997 Asia Financial Crisis. Funds are leaving several major stock markets in Asia. Most of the Asian currency has depreciated against USD 3 days streak after the surprising move by China.

4. Weakening commodity prices, especially crude oil and palm oil prices, further reduce the confidence of investors towards Malaysia.

5. Brent oil price stood at USD 47.21 per bbl; a 56% discount from it's peak at USD 105 per bbl about a year ago. Petronas, a state-owned oil and gas giant, has seen a whopping 57% drop in the upstream business revenue, from RM 32.4 billion to RM 14 billion comparing year -to-date in FY14 and FY15.

6. The palm oil price also dropped 56% from USD 1,250/MT to USD 575/MT.

7. GST of 6% was imposed starting 1st April 2015. Malaysians has to pay more for the same goods, which in turn discourage consumer spending especially the wage earners.

8. Property market also slowdown recently, making the property stocks lackluster. Federal loan tightening has led to increased loan rejection rate among home buyers. Foreign speculators are filter out of the market since the RPGT was drastically increased since 2013.

9. Debt laden government investment arm 1MDB was revealed to have invested the money without due diligence, and accumulated a 42billion debt over the years. Since then, foreign funds has started to leave Malaysian capital market. RM 9.152billion funds has left Malaysia in 2014.

10. The capital exodus is exaggerated up to RM15billion has left Malaysia up to mid August 2015, when the Prime Minister is involved in a political scandal of receiving a RM2.6 billion "Political Donation" from abroad, and a series of extreme measure taken to interrupt the investigation against him.

11. International investors has decided to leave Malaysia, despite that the Federal Governor Tan Sri Zeti Aziz reiterated that Ringgit is undervalued on 13 August 2015. Earlier in April 2015, she made a similar statement when Ringgit was observed at a depreciating trend.

12. Hidden risk ahead as the United States Federal Reserve rate revision in September 2015, further expanding the gap between the weakening Asian currency against USD.

13. Even though China has stated that the Chinese Yuan devaluation was a one-off event on 11st August 2015, the Yuan was de-valuated further in the next day. There is still a possibility for China to make currency adjustment whenever deemed necessary. China GDP growth is seen slowing down to 7.7% since their last peak in 2007, at 14.2%.

14. Malaysians are very much angered by the recent political dramas and the mishandling of taxpayer's money by the government and the fact that they felt democracy is being challenged. A Bersih 4.0 Rally is scheduled on 29th and 30th of August. Too many uncertainties at this moment to predict what will actually happen during the rally, as the ruling coalition has been growing extremes in the measures taken to ensure the continuation of their reign.

15. Foreign Direct Investment (FDI) was almost halved in 1H2015 compared to previous year, dropping from RM 36.6 billion to RM 21.3 billion despite a 1.3% growth in overall investment in Malaysia to RM 113.5billion.

Wednesday, 19 August 2015

Bread and Butter

Bread and Butter

Bread and butter appears almost everyday in our lives; or at least, they are what many people start their days with.

Bread and Butter is simple yet fulfilling.

In Bread and Butter, everything goes very fundamental. No verbosity, straight to the point.

This is a place where information, knowledge and wisdom is shared to enhance the value of life.

Have fun, and be fruitful.

Subscribe to:

Comments (Atom)